Present Value Formula Step by Step Calculation of PV

One way to solve present value problems is to apply the general formula we developed for the future value of a single amount problems. The value of a future promise to pay or receive a single amount at a specified interest rate is called the present value of a single amount. Net present value (NPV) can be very useful to companies for effective corporate budgeting.

Where Should We Send Your Answer?

- In this section we will demonstrate how to find the present value of a single future cash amount, such as a receipt or a payment.

- It means if the amount of €3,415 is invested today @10% per year compounded annually, it will grow to €5,000 in 4 years.

- This discount rate takes into account the time value of money, which means that money today is worth more than the same amount of money in the future.

- It represents your forgone rate of return if you chose to accept an amount in the future vs. the same amount today.

- If there are two or more future amounts occurring at different times for an investment, their present value can be determined by simply discounting each amount separately.

- To find the present value, the amount of €5,000 to be received in future would be discounted using the given interest rate of 10%.

NPV essentially works by the formula to compute the present value of a single sum is: figuring out what the expected future cash flows are worth at present. It then subtracts the initial investment from that present value to arrive at the net present value. The project may not be profitable and should be avoided if it’s negative. PV is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash flows.

Where should we send your answer?

For example, a company will have a Cash account in which every transaction involving cash is recorded. A company selling merchandise on credit will record these sales in a Sales account and in an Accounts Receivable account. Over the years 2024 through 2026, ledger account the balance in Discount on Notes Receivable will move from a credit balance of €249 to a balance of zero. Let’s use the Present Value (PV) calculation to record an accounting transaction. If you know any three of these four components, you will be able to calculate the unknown component. Accountants are often called upon to calculate this unknown component.

- Small changes in the discount rate can significantly impact the present value, making it challenging to accurately compare investments with varying levels of risk or uncertainty.

- Let’s say you’re contemplating setting up a factory that’s going to need initial funds of €250,000 during the first year.

- The present value formula is applied to each of the cash flows from year zero through year five.

- Accountants are often called upon to calculate this unknown component.

- Given our time frame of five years and a 5% interest rate, we can find the present value of that sum of money.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

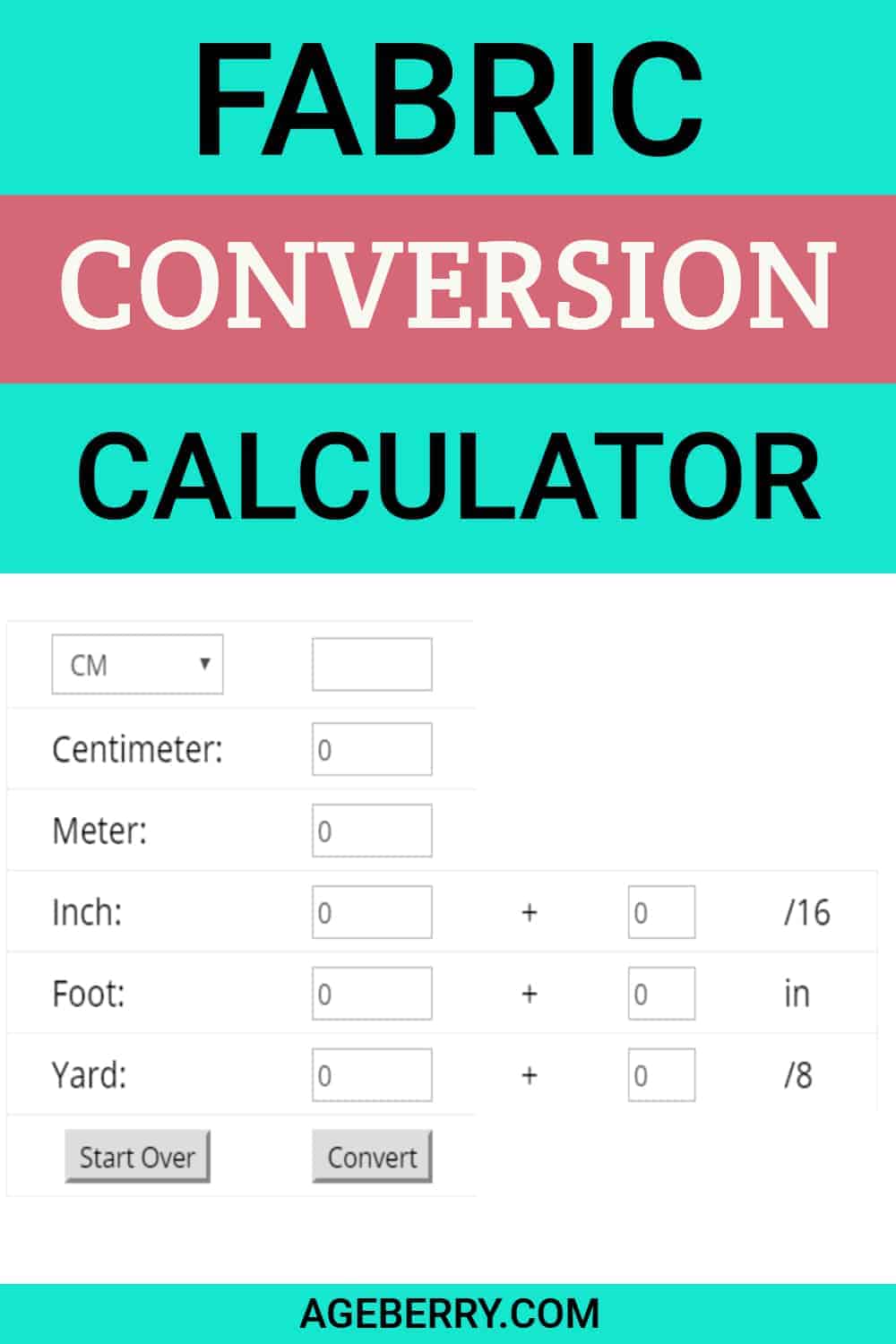

- Behind every table, calculator, and piece of software, are the mathematical formulas needed to compute present value amounts, interest rates, the number of periods, and the future value amounts.

Advance Your Accounting and Bookkeeping Career

A net present value that’s less than €0 means a project isn’t financially feasible and should be avoided. Excel is a great tool for making rapid calculations with precision but errors can occur. A simple mistake can lead to incorrect results so it’s important to take care when inputting data. Assume that your project will need an initial outlay of €250,000 in year zero.

Formula to Calculate Present Value (PV)

Let us take the example of John who is expected to receive €1,000 after 4 years. Determine the present value of the sum today if the discount rate is 5%. The present value formula is applied to each of the cash flows from year zero through year five. The cash flow of -€250,000 results in the same present value during year zero. Year one’s inflow of €100,000 during the second year results in a present value of €90,909. Year two’s inflow of €150,000 is worth €123,967 and so on through the years.

- While useful, it is dependent on making good assumptions on future rates of return, assumptions that become especially tricky over longer time horizons.

- Since the interest is compounded monthly, the number of time periods (n) is 24 (2 years x 12 months per year).

- We are applying the concept to how much money we need to buy a business.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Present value is a way of representing the current value of a future sum of money or future cash flows. While useful, it is dependent on making good assumptions on future rates of return, assumptions that become especially tricky over longer time horizons. For example, if you are due to receive €1,000 five years from now—the future value (FV)—what is that worth to you today? Using the same 5% interest rate compounded annually, the answer is about €784.

Inaccurate cash flow estimates can lead to incorrect present values, which may result in suboptimal investment decisions. Higher interest rates result in lower present values, as future cash flows are discounted more heavily. The present value of an amount refers to today’s value of the amount to be received at a point of time in future. The concept of present value is frequently used in capital budgeting techniques and its understanding is important for managers, business owners and others involved in making capital budgeting decisions. Examples of capital budgeting techniques that take into account the present value of money are net present value (NPV) method, internal rate of return (IRR) method and discounted payback method. Because the PV of 1 table had the factors rounded to three decimal places, the answer (€85.70) differs slightly from the amount calculated using the PV formula (€85.73).

How confident are you in your long term financial plan?

It means if the amount of €3,415 is law firm chart of accounts invested today @10% per year compounded annually, it will grow to €5,000 in 4 years. The present value is computed either for a single payment or a series of payments to be received in future. This article explains the computation of present value of a single payment to be received at a single point of time in future. To understand the computation of present value of a series of payments to be received in future, read present value of an annuity article.